Instant Notes: 3. Cost Estimation

3. Cost Estimation

-

The capital needed to supply the necessary manufacturing and plant facilities is called the fixed-capital investment, while that necessary for the operation of plant is termed the working capital.

-

Total capital investment = fixed capital investment + working capital + cost of land

-

Land is not part of the fixed capital investment, and is not depreciable. Fixed cost components are depreciable. Cost of land is about 3% of the fixed capital investment.

-

Most chemical plants use an working capital accounting to 10 to 20% of the total capital investment.

-

Following is the breakdown of the fixed capital investment for a chemical process:

-

Direct cost: it can be further divided into onsite and off-site costs.

-

onsite: purchased equipments, purchased equipment installation, piping, instrumentation and control, electrical equipment.

-

offsite: land, yard improvement, building.

-

-

Indirect cost: engineering supervision, construction expenses, contractor’s fee, contingency.

-

-

Cost Indexes: for updating cost data from cost data for a particular year. \[ \text{Present cost} = \text{original cost } \times \left(\frac{\text{index value at present time}}{\text{index value at time original cost was obtained}}\right) \]

-

Cost-capacity Relationship: \[\text{Cost of equipment of } a = \text{cost of equipment } b \times \left(\frac{\text{capacity of equipment } a }{\text{capacity of equipment } b }\right)^{n}\] This equation permits the user to obtain a cost for an equipment item of a different size when the cost for given size is known. Normally six-tenths factor rule is used. According to this rule, \(n=0.6\)

However, the application of the 0.6 rule of thumb for most purchased equipment is an oversimplification, since the actual values of the cost-capacity factor vary from less than 0.2 to greater than 1.0. Because of this, 0.6 factor should only be used in the absence of other information. In general, the cost-capacity concept should not be used beyond a tenfold range of capacity.

If we assume that for an equipment item, a cost-capacity exponent is 0.6, doubling the capacity will increase the cost about 50–60%, not 100%. The economy of scale is reflected in the exponent.

If the exponent is less than 1.0, there is an economy of scale. As \(n\) approaches the value of 1, the economy of scale disappears. An exponent greater than 1.0 is a negative economy of scale and multiple equipment units should be used.

-

\(\displaystyle \text{Turnover ratio} = \frac{\text{gross annual sales}}{\text{fixed capital investment}}\)

The reciprocal of turnover ratio is sometimes defined as the capital ratio or investment ratio. For the chemical industry, as a very rough rule of thumb, the turnover ratio can be approximated as 1. -

Lang multiplication factors for estimation of fixed-capital investment or total capital investment (Ref: Plant Design and Economics for Chemical Engineers - Peters & Timmerhaus, McGraw-Hill) \[\text{Capital investment} = \text{Lang's factor} \times \text{Delivered equipment cost}\]

Factor for Type of plant Fixed-capital Total capital investment investment Solid-processing plant 3.9 4.6 Solid-fluid-processing plant 4.1 4.9 Fluid-processing plant 4.8 5.7 -

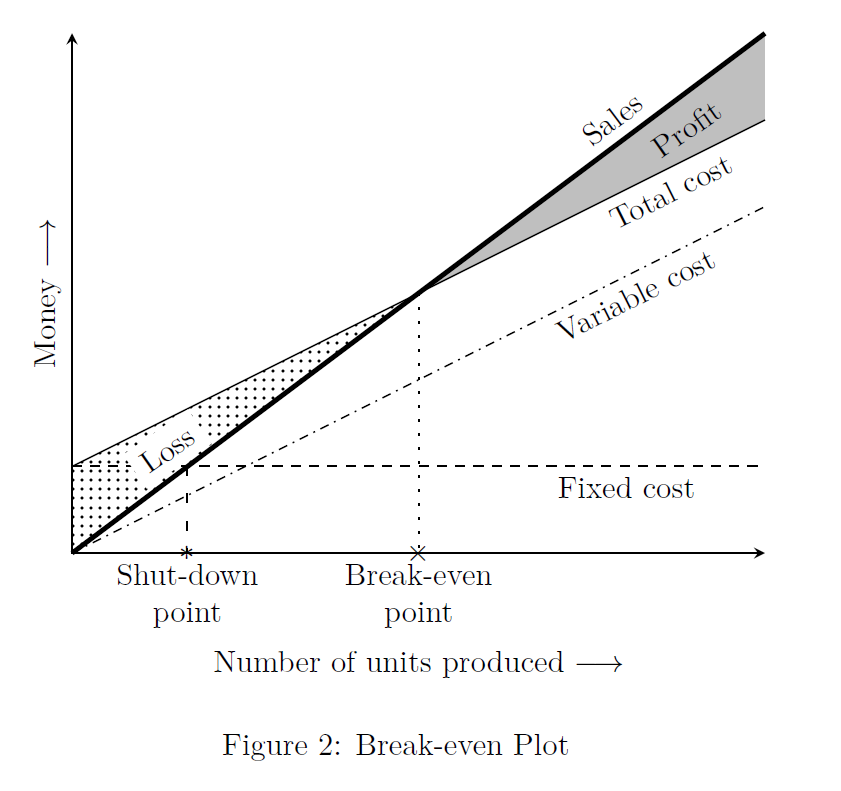

Break-Even Point (BEP): Refer to Fig.(2).

The fixed cost remains constant, and the total production cost increases as the rate of production increases. The point where the total production cost equals the total sales is known as break-even point (BEP). \[\text{BEP} = \frac{\text{Fixed cost}}{\text{Sales income per unit}-\text{Variable cost per unit}}\]

Examples of fixed cost are property taxes, depreciation, administrative salaries, rent, interest on long-term loans, and so forth. Examples of variable costs are raw material, direct labor, and so forth.

At shut-down point, sales = fixed cost. If a company cannot meet its fixed expenses, it should shut down operations. For a short period of time a company may operate between the BEP and the Shutdown point to maintain customers.